Have you always wanted to teach your child the importance of money and how to manage it better? Then, the Institute for Financial Literacy’s MoneySense for Your Child workshop is for you.

The not-for-profit Institute for Financial Literacy is a collaboration between MoneySense and Singapore Polytechnic Enterprise Pte Ltd. It conducts free, online workshops for parents.

These workshops for parents provide invaluable tips on how to introduce kids to financial matters and how to make them more savvy about money.

Financial Literacy can be Taught from a Young Age

Most people recognise that learning to manage money is a life skill. What fewer people realise is that financial literacy is something that can be taught from an early age.

Kids as young as 3 years old can start picking up basic concepts about saving, spending and sharing. Parents play an important role in inculcating these money habits in their children by modelling good financial practices at home.

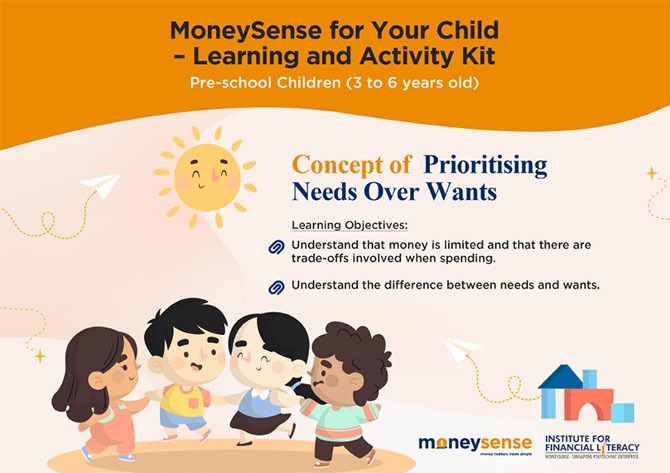

The MoneySense for Your Child workshop provides a helpful framework on what are these good financial habits and how to education children about financial literacy. It outlines appropriate levels of financial knowledge for three age groups – preschoolers between the ages of 3 to 6, primary schoolers from 7 to 12, and teens who are 13 to 16 years old.

Examples of the type of concepts covered in workshop include “Prioritising Needs Over Wants”, “Budgeting and Delayed Gratification” and “Concept of Planning”.

If such concepts sound as if they could be too abstract for children, that’s where MoneySense for Your Child comes in. During the MoneySense for Your Child workshop, parents will receive helpful suggestions on how make these important financial concepts easy-to-understand and relatable to children.

For example, as an introduction to “Needs” and “Wants”, parents can have a discussion with their children about whether it is essential to own a mobile phone.

Such ideas provide a useful and tested approach towards developing greater financial literacy in children.

Activity Ideas for You and Your Child

To complement the free workshop, the Institute for Financial Literacy provides activity kits tailored to engage children of different ages. These free resources equip parents with ingenious ways to share with kids about financial concepts.

Download Free Activity Kits for Children here:

- Activity and Learning Kit for 3 – 6 Years Old

Learn the Concept of Prioritising Needs Over Wants - Activity and Learning Kit for 7 – 12 Years Old

Learn the Concept of Delayed Gratification and Budgeting - Activity and Learning Kit for 13 – 16 Years Old

Learn the Concept of Planning

For example, there are “Play Time Tokens” which can be used to teach primary school level children about budgeting their play activities over the week.

The age-appropriate ideas found in the activity kits help to reinforce key concepts, making ideas tangible and easy-to-grasp for children.

Institute for Financial Literacy’s MoneySense for Your Child Workshop Schedule

Learning to manage money is an important life skill. It is a skill which kids can start picking up from a young age.

Any parent who is interested in helping his or her child become more well-versed in managing money will benefit from the Institute for Financial Literacy’s MoneySense for Your Child workshops.

The 90-minute online parent workshop is well-worth the time invested in order to be able to pass on lifelong skills and habits to the next generation.

Find out more and register for the FREE MoneySense for Your Child workshops here.

![Eurasian Heritage Gallery: History, Community And Heroes [2024] Eurasian Heritage Gallery: History, Community And Heroes](https://www.littledayout.com/wp-content/uploads/13-eurasian-heritage-centre-218x150.jpg)